Armando.info: The hacking from North Macedonia was on PDVSA and not on the elections

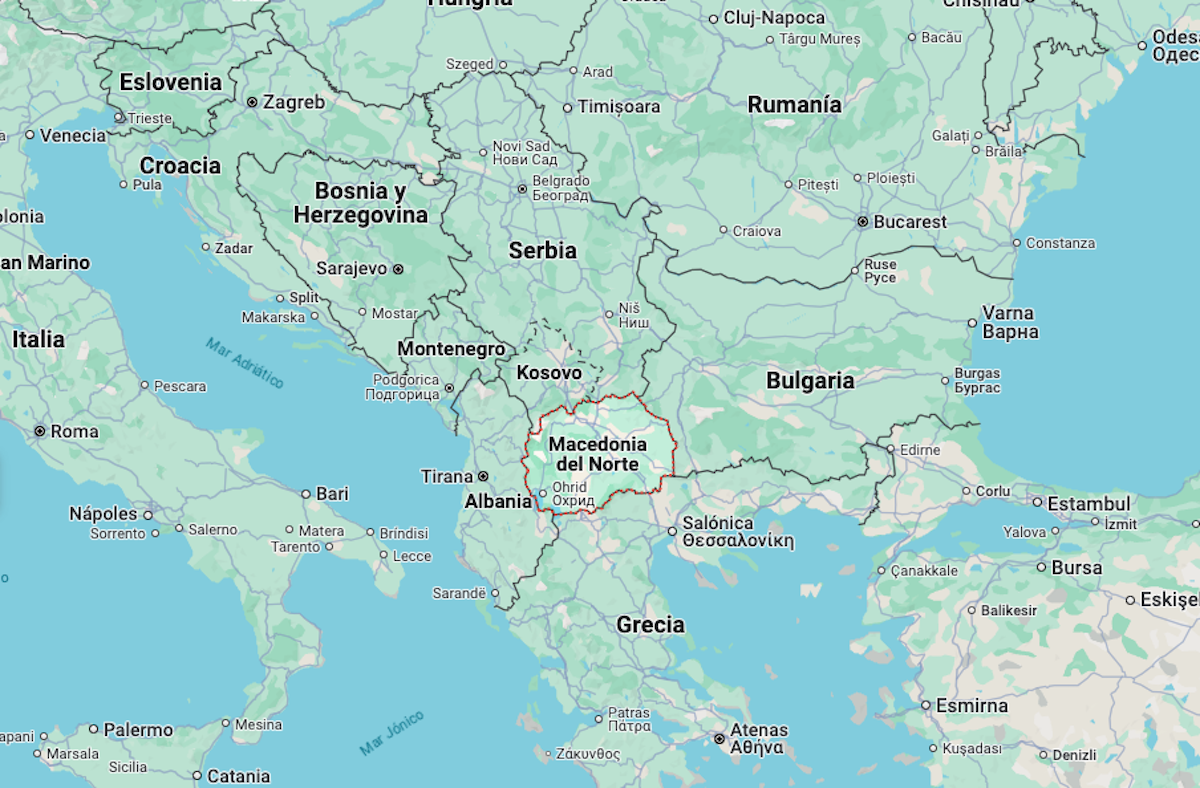

When the attorney general appointed by the Chavista Constituent Assembly in 2018 and recently ratified, Tarek William Saab, solemnly assured that the vote transmission system for the presidential election on July 28 had been the target of a “(cyber) attack carried out from Macedonia of the North”, few Venezuelans could locate the Balkan country on the world map. Without major bilateral relations, with both nations separated by more than 8,000 kilometers and an inconsequential trade balance, Saab’s version, which was mocked on social networks, suggested a connection between Venezuela and North Macedonia that, in the end, lack of evidence, it turned out to be unfounded.

But that didn’t mean there wasn’t a binational connection. Although unknown until 2021, this was very real and remains the subject of investigations. At the end of 2021 in Skopje, the Macedonian capital, the Eurostandard Bank, owned by two funds from the canton of Lugano, in the Italian-speaking part of Switzerland, declared bankruptcy. The bankruptcy left almost 140,000 clients in ruin. From that financial earthquake, so distant and unnoticed by Venezuelans, unexpected clues emerged about negotiations with PDVSA, the state oil company that the Bolivarian regime has used as a “cash cow” that it milks until it is dry.

An independent audit that the Slovenian firm RUR Consulting carried out to analyze the causes of the bank’s bankruptcy, published in April 2022, highlighted that Eurostandard Bank condemned itself for its participation in an “illegal lending scheme” in which Other Macedonian financial institutions and companies also acted for almost two decades. In this scheme, according to the auditors, some intermediary companies served to channel loans to others that did not qualify by banking standards to obtain them on a regular basis. The document concludes that, due to the non-payment of loans granted to these companies that were foreseeably delinquent, the system went out of control and caused large losses in the banks, mortally wounding Eurostandard Bank.

Aside from these general findings, a footnote in the report caught attention: while in the first three quarters of 2019 the Eurostandard Bank was heading into bankruptcy, “clients from Venezuela” had deposited 110 million euros through bank accounts, of which some 10 million were given in loans to the “bank’s most exposed clients.”

The report does not offer further details, nor does it clarify how these transactions were related to the loan scheme or what role they played in the bank’s bankruptcy, but its author, Drago Kos, said in a 2022 interview with local press that The 110 million deposited by the then anonymous Venezuelans seemed to have been “absolutely necessary for Eurostandard Bank to remain alive.” But now an investigation, carried out jointly by Armando.info, the Organized Crime and Corruption Reporting Project (Occrp, for its acronym in English) and the Investigative Reporting Lab (IRL) of North Macedonia, allows us to verify that these There were 11 Venezuelan clients, of which five were PDVSA contractors and one was a former senior official on the oil company’s board of directors, now in prison in Caracas.

By Valentina Lares

More details in Armando.info.

Related News

Independent journalism needs the support of its readers to continue and ensure that the uncomfortable news they don’t want you to read remains within your reach. Today, with your support, we will continue working hard for censorship-free journalism!